Unlocking Profits with Forex Trading Signals: A Comprehensive Guide

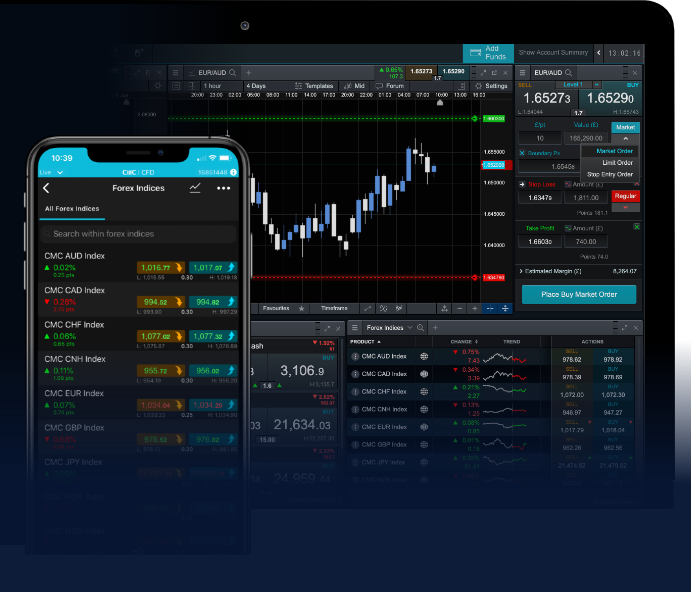

In the fast-paced world of forex trading, timely and accurate information is key. Forex trading signals provide traders with insights and recommendations to make informed decisions. By leveraging forex trading signals Trading Platform TH, you can access a wide range of trading signals tailored to your needs.

What Are Forex Trading Signals?

Forex trading signals are actionable insights that traders can use to determine the best times to enter or exit trades in the currency markets. These signals can be generated from various sources, including technical analysis, fundamental analysis, or even automated trading systems. The core idea behind these signals is to make trading decisions easy and efficient, especially for those who may not have the time to conduct in-depth analysis themselves.

Types of Forex Trading Signals

There are several types of forex trading signals that traders can utilize:

- Technical Signals: These signals are based on chart patterns, indicators, or price action. For instance, traders might use moving averages, MACD, or RSI to generate buy or sell signals.

- Fundamental Signals: These signals arise from economic news releases, central bank announcements, or geopolitical events that can impact currency prices. Traders monitor economic calendars to stay updated.

- Sentiment Signals: These signals are derived from market sentiment and trader behavior. Tools that analyze trader sentiment can indicate whether the market is leaning bullish or bearish.

- Automated Signals: Some traders rely on algorithmic trading systems or trading bots that generate signals based on predefined criteria without the need for human intervention.

Benefits of Using Forex Trading Signals

Using forex trading signals has several advantages, particularly for both novice traders and seasoned professionals:

- Time-Saving: Forex trading signals save time by providing concise recommendations instead of requiring traders to analyze data extensively.

- Improved Accuracy: Many trading signals are generated by experts with years of experience, increasing the chances of making successful trades.

- Increased Confidence: For beginners, having signals to rely on can increase their confidence in making trading decisions, helping them navigate the markets.

- Diversification: Signals can help traders explore different currency pairs or trading strategies they may not have considered otherwise, enhancing their trading portfolio.

How to Choose the Right Forex Trading Signals

With numerous forex trading signal providers in the market, selecting the right one can be overwhelming. Here are some key factors to consider:

- Reputation and Reviews: Investigate the background of the signal provider. Look for reviews, testimonials, and any verifiable track record of success.

- Transparency: Reliable signal providers should be transparent about their trading strategies and performance. Be wary of those who make unrealistic profit claims.

- Cost: Forex signals can be free or offered through subscription models. Evaluate whether the cost aligns with the quality and effectiveness of the signals offered.

- Compatibility: Ensure that the signals are compatible with your trading platform and style. Some providers cater specifically to day traders, while others focus on swing or long-term trading.

How to Use Forex Trading Signals Effectively

Once you’ve selected a reliable forex trading signal provider, it’s essential to know how to use these signals effectively:

- Understand the Signals: Before taking action, read the signal carefully and understand the rationale behind it. If the analysis is not clear to you, seek to learn more about the indicators or patterns used.

- Combine with Your Analysis: Integrate trading signals with your own technical or fundamental analysis for better decision-making. Don’t rely solely on signals; they are tools to enhance your trading.

- Manage Risk: Always use risk management strategies, such as setting stop-loss levels. Signals can be inaccurate at times, and protecting your capital is paramount.

- Stay Updated: Market conditions can change rapidly. Stay informed about news events and updates that could impact the market, which may not be covered by the signal provider.

Final Thoughts

Forex trading signals can be valuable tools in a trader’s arsenal, providing critical insights and saving time. Whether you’re a new trader seeking guidance or a seasoned trader looking to refine strategies, understanding how to effectively utilize trading signals can enhance your trading performance. Remember to do your due diligence in selecting reliable providers, and always integrate signals into your broader trading strategy for the best results. Embrace technology and leverage forex signals to unlock the potential for consistent profit.